SNEAK PEEK

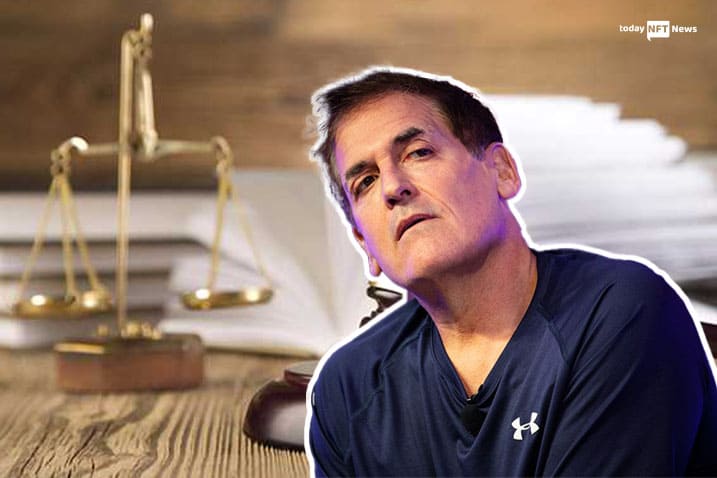

- A class action lawsuit against Mark Cuban for supporting the bitcoin broker Voyager Digital is now pending.

- Cuban and Stephen Ehrlich, CEO of Voyager Digital, are accused in the case of using expertise to convince consumers to deposit their life savings in a Ponzi Scheme.

- The class action generally aims to make Cuban and Ehrlich responsible for making up the more than $5 billion in losses suffered by investors.

Owner of the Dallas Mavericks and multi-billionaire businessman Mark Cuban is the most recent defendant to be sued. The billionaire is the subject of a class action lawsuit over his support for cryptocurrency broker Voyager Digital.

The Moskowitz Law Firm sued Cuban in civil court in Southern Florida for advertising Voyager’s unlicensed cryptocurrency products. A jury trial was demanded in action.

Cuban was accused of repeatedly misrepresenting the company, including making questionable claims that it offered “commission-free” trading services and was less expensive than rivals. The lawsuit claims that Cuban and the CEO of Voyager Digital, Stephen Ehrlich, used their years of experience to entice uninformed clients into investing their life savings in a Ponzi Scheme.

It further states that the company sold investors Voyager Earn Program Accounts, which are unregistered securities.

In general, the class action seeks to hold Cuban and Ehrlich accountable for paying back the more than $5 billion that investors lost. The lawsuit also considered remarks made by Cuban in support of Voyager. Additionally, it charged Cuban and Ehrlich with falsifying information to entice investors who paid fees despite being promised free services. Earlier Mark Cuban stated that he is not a big fan of the idea of the Metaverse.

One of the organizations affected by the financial pandemic that the Terra collapse and the Crypto Winter injected into the cryptocurrency market was Voyager Digital. When the broker declared on July 1 that it had decided to halt withdrawals from its platform, the problems with the broker became evident. Exposure to the now-defunct Three Arrows Capital was mentioned.

Voyager Digital soon after submitted a Chapter 11 bankruptcy petition. The company has more than 100,000 creditors, according to the bankruptcy procedures. The statement listed assets and liabilities between $1 billion and $10 billion.

Voyager’s bankruptcy judge in New York granted Voyager permission to refund $270 million in client funds held at the Metropolitan Commercial Bank (MCB). A day later, the loan company announced that starting August 11, customers with US dollars in their accounts would be able to withdraw up to $100,000 in 24 hours, with funds arriving in 5-10 working days.