SNEAK PEEK

- Karl Racine, Washington, DC’s Attorney General, made an announcement that he is filing civil charges against MicroStrategy and Michael Saylor over alleged tax fraud.

- MicroStrategy is certainly the largest holder of Bitcoin among public firms and has allegedly helped Saylor evade taxes.

- Saylor reportedly utilized an elaborate scheme to avoid paying income taxes in DC between the years 2014 and 2020.

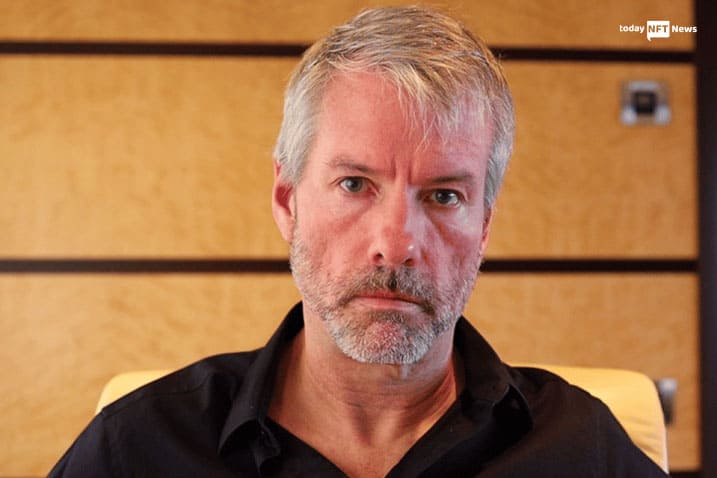

The Attorney General of Washington, DC, Karl Racine, has recently made an announcement regarding his move to file civil charges against MicroStrategy and Michael Saylor, its Founder for tax evasions. The cloud computing software company MicroStrategy holds the largest Bitcoin treasury and has helped Michael Saylor evade taxes.

NEW: Today, we’re suing Michael Saylor – a billionaire tech executive who has lived in the District for more than a decade but has never paid any DC income taxes – for tax fraud.

— AG Karl A. Racine (@AGKarlRacine) August 31, 2022

As per the tweet shared by the Attorney General, Saylor has evaded taxes that he legally owes on millions of dollars he earned in DC. Saylor has been living in DC for over a decade now, but he has never paid any of the income taxes during his tenure in DC.

In accordance with a press release shared officially from the Attorney General’s office, Saylor is accused of utilizing an elaborate scheme in order to avoid paying income taxes in DC between the years 2014 and 2020. Well, in response to this, Saylor cunningly claimed that he was a resident of Florida, a state with no income taxes, but was actually present in DC mostly.

The investigations carried out following the lawsuit to dig up the same revealed that Saylor avoided paying over $25 million worth of DC income taxes. As per the Attorney General’s beliefs, MicroStrategy was a notable part of the conspiracy in enabling the scheme involving filing false W-2 statements with his Florida residence mentioned.

It is assumed on the basis of calculations involving penalties and overall unpaid taxes that both MicroStrategy and Michael Saylor could be answerable for over $100 million.

In his response to the lawsuit filed against him, Saylor addressed that he purchased a historic house in Miami Beach and shifted his home there from Virginia. Adding to a greater extent to his statement, he said that even though MicroStrategy is based in Virginia, Florida is his home and is the center of his personal and family life.

MicroStrategy opposed the lawsuit and addressed the fact that the case is a personal matter involving Michael Saylor. Hence, the company is not responsible for his personal affairs and individual tax responsibilities.

It concluded with the statement mentioning that the company did not conspire with Michael Saylor in the discharge of his personal tax duties.