SNEAK PEEK

- A Twitter thread accused Do Kwon of cashing out $80 million, per month for 3 years.

- Do Kwon has dismissed the rumors through a series of tweets.

- The entrepreneur has been summoned to attend a parliamentary hearing on the matter in South Korea.

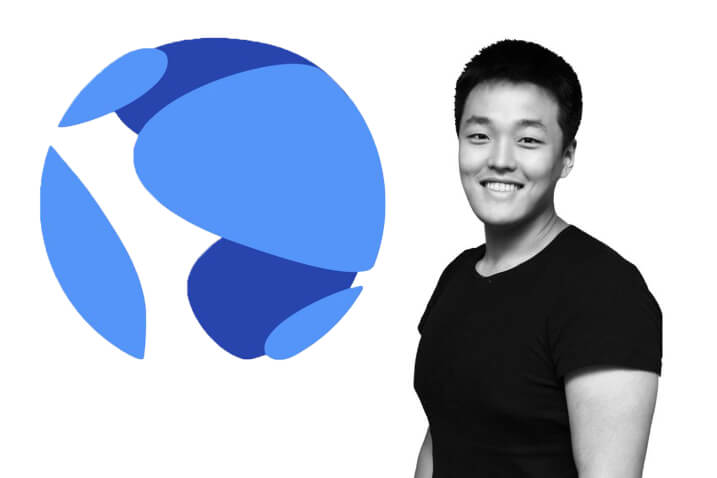

CEO and co-founder of the not-so-famous Terra (LUNA) and TerraUSD (UST) ecosystem, Do Kwon has rejected the claims of cashing out $80 million every month for three years consecutively.

On June 11, multiple unconfirmed reports claimed Kwon’s participation in the cash draw on LUNA and UST prior to the crash to buy US dollar-pegged stablecoins like Tether (USDT).

These rumors made their way after a Twitter thread by @FatManTerra shared the alleged details on how Kwon and other influencers drained funds while maintaining the liquidity.

🧵 Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: the perfect mechanism to drain liquidity out of the LUNA & UST system and into hard money like USDT. (1/13)

— FatMan (@FatManTerra) June 11, 2022

Replying to the tweet, Kwon urged the crypto community to keep away from spreading the rumor until it was proven true. He further said:

This should be obvious, but the claim that I cashed out $2.7B from anything is categorically false.

1/ This should be obvious, but the claim that I cashed out $2.7B from anything is categorically false

— Do Kwon 🌕 (@stablekwon) June 12, 2022

The entrepreneur mentioned that the rumor of him cashing out $80 million per month contradicts the claims that he still holds most of his LUNA holdings, procured during the airdrop. Additionally, he stated that over the past two years, his income has only been a cash salary from TerraForm Labs (TFL).

3/ To reiterate, for the last two years the only thing ive earned is a nominal cash salary from TFL, and deferred taking most of my founder’s tokens because a) didn’t need it and b) didn’t want to cause unnecessary finger pointing of “he has too much”

— Do Kwon 🌕 (@stablekwon) June 12, 2022

I didn’t say much because I don’t want to seem like playing victim, but I lost most of what I had in the crash too. I’ve said this multiple times but I really don’t care about money much.

Mr. B, a developer from Anchor Protocol, a Terra-centric sub-ecosystem, warned Kwon regarding the impractical high-interest rates. He said that the platform was designed to offer an interest rate of 3.6% to maintain the stability of the Terra ecosystem stable; however, it was changed to 20% just before the release:

I thought it was going to collapse from the beginning (I designed it), but it collapsed 100%.

He suggested Kwon to reduce the interest rates but the request was refused. Do Kwon has been summoned to attend a parliamentary hearing on the matter in South Korea.

Earlier, Today NFT News reported how Terra Community Offers Distribution Method for 0.5% LUNA Emergency Allocation