SNEAK PEEK

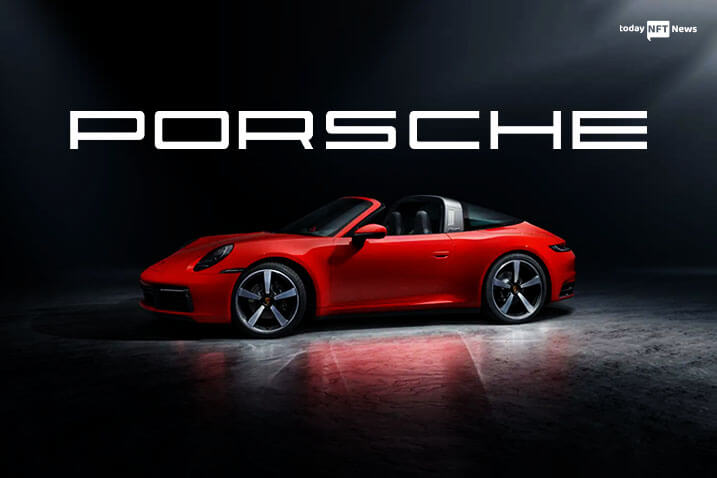

- Porsche launched its much awaited NFT collection on January 23, 2023.

- The collection’s floor price has fallen below its minting price on secondary marketplaces.

- The hefty mint price and the sales strategy not being in accordance with Web3 ethos are the reasons behind the falling mint price.

On January 23, 2023, Porsche released its very first NFT collection; however, the project’s resale prices aren’t as high as expected by fans. The collection has 7,500 NFTs, which pay tribute to the legendary 911 sports car of the brand.

The minting for allowlist owners began at 9 a.m. EST in four waves, with each wave spanning one hour.

How to mint your Porsche 911?

— PORSCHΞ (@eth_porsche) January 23, 2023

⚠️ Mint starts soon. First things first, make sure you are registered on our official website https://t.co/gDi9408OjH. Once the time for your Mintwave has come, you have 1 hour. If you miss it, you will have to wait until the mint goes public. pic.twitter.com/oJ5dbz4jwH

After its ending, the mint was released to the public. Every collector was enabled to mint up to three virtual 911 Porsches, with the price of each being 0.911 ETH.

In the next phase of the mint process, owners could pick one of the three paths to carry on with and customize the design as well as the rarity of the NFTs they owned.

Within hours of the mint’s opening, the collection’s sale suddenly stopped. As of yesterday’s evening, only 1198 non-fungible tokens were sold via the official website of Porsche.

Secondary market sales looked inactive as well. The floor price fell, and the collection was selling for $50 cheaper even when the mint was still going on.

In December 2022, Porsche announced its NFT endeavor at Miami Art Week with high expectations.

The costly mint price and the sales strategy that looked like it was not in line with the Web3 ethos were the reasons behind certain Twitter users’ being against the collection.

The Porsche mint is a perfect example of why even the most established brands need to partner with Web3 natives to enter the space in a real way.

— 0://wilder.frank (@realfrankwilder) January 23, 2023

An artist and founder of Allships, an NFT creative agency, Dave Krugman, opened up about his opinion regarding the mint price of the collection. He shared that while entering into Web3, popular Web2 brands must have a long-term approach when it comes to launching NFTs.

He added that when moving into the Web3 space by taking the community’s millions of dollars, companies set quite high expectations. They cut out 99% of their market competitors and overrated their own assets even before proving that they could back up their valuation.