SNEAK PEEK

- NFT collector Brandon Riley accidentally deleted an NFT with 77 ETH from circulation.

- The incident happened when Riley was going through the unfamiliar process of wrapping NFTs.

- The collector wanted to purchase some funds to buy another NFT.

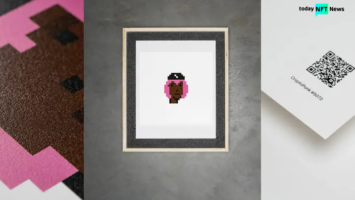

A CryptoPunk NFT worth 77 Ether was sent to a burn address to be permanently damaged. However, the collector wished to borrow funds against it for the purchase of some other non-fungible token.

On March 13, Brandon Riley, an NFT collector, paid 77 ETH and added CryptoPunk #685 to his collection with the hope of keeping it for a long time.

Now feels like an appropriate time to introduce #BAYC 586 to #Punk 685 (acquired a week ago). Hope to hold both for a decade… LGF! 🚀 pic.twitter.com/SLb68rY6MR

— Brandon Riley (@vitalitygrowth) March 19, 2023

Riley knew how crucial it was to procure new NFTs exactly before crypto markets took off into a whole new bull market. Therefore, he planned to borrow funds against CryptoPunk #685 via wrapping, a famous technique.

Yup, prolly didn’t to the first part to create a dedicated proxy address, but instead used the default proxy address which is burn. “9. proxyInfo to get your proxy wallet address”

— 0x-hodl.eth (@0x_hodl) March 24, 2023

During the unknown process of wrapping NFTs, he unintentionally sent the asset to a burn address, thereby, deleting the NFT from circulation permanently.

Riley said that he was told to follow the directions as they were, and that’s what he did. However, while doing so, he lost 77 ETH worth $135,372.16. He added that he wasn’t wrapping the particular Punk to sell on the Blur marketplace. The number is the reverse of his Ape, and the reason he was wrapping it was his need to borrow certain liquidity from it.

Crypto Twitter members believed that he must have had a lot of money, and Riley disclosed buying CryptoPunk #685 upon borrowing money.

Riley said that he probably shouldn’t have tried doing so. However, crypto Twitter also condemned confusing interfaces and complicated commands for the loss of the investor. Owing to this, the community collectively agreed on the need to revive the front-end procedures for crypto ecosystems.

Today NFT News previously reported an increase in NFT wash trading by 126% in February. OpenSea, X2Y2, LooksRare, Magic Eden, CryptoPunks, and Blur were among the top six marketplaces. LooksRare, X2Y2, and Blur witnessed a rise in wash trading for the fourth consecutive month with an overall volume of $580 million.

Meanwhile, a lack of clear regulations is the reason behind wash trading.